In today's fast-paced business environment, managing travel expenses efficiently is crucial for sustainable growth. A smart mileage tracker solution presents an opportunity to enhance both accuracy and productivity by automating the mileage logging process.

By integrating features like GPS tracking and automatic trip detection, businesses can reduce errors and streamline compliance with tax regulations. However, selecting the right mileage tracker requires careful consideration of various factors.

What should organizations prioritize when choosing a solution that aligns with their operational needs? The answer may reveal more than just convenience.

Consistently tracking mileage offers numerous benefits that can significantly enhance both personal and business financial management. Accurate mileage tracking ensures precise expense reporting, enabling individuals and companies to maximize tax deductions or reimbursements.

By maintaining a detailed record of travel, businesses can identify patterns in travel expenses, facilitating better budgeting and cost control. Moreover, effective mileage tracking helps in evaluating the efficiency of business operations, allowing for informed decisions regarding travel policies and resource allocation.

Furthermore, it minimizes the risk of errors in financial documentation, promoting compliance with tax regulations. Ultimately, adopting a systematic approach to mileage tracking not only streamlines financial processes but also fosters greater accountability and transparency in travel-related expenditures.

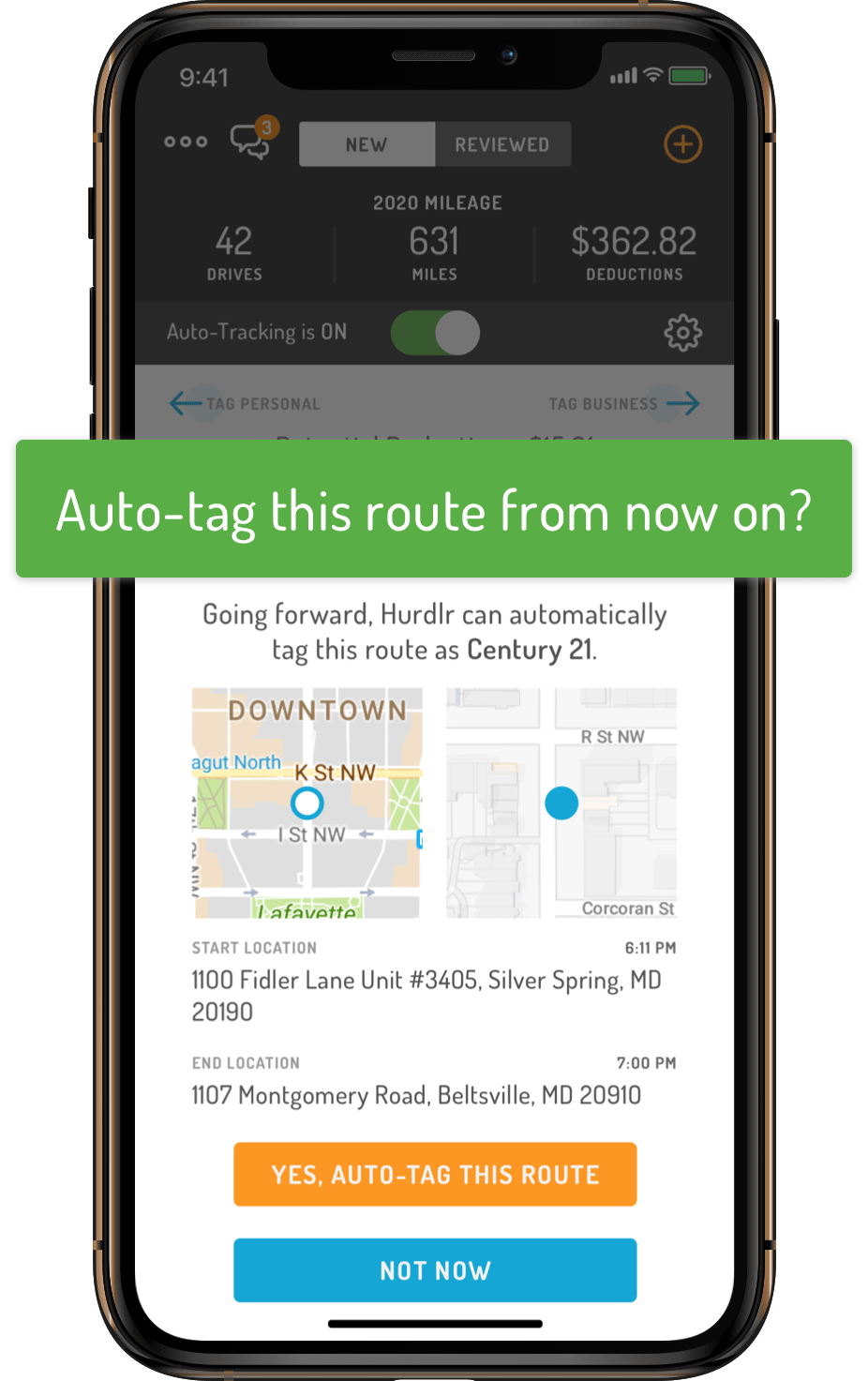

Smart mileage trackers come equipped with a range of key features designed to enhance the efficiency and accuracy of mileage tracking. One of the primary features is automatic trip detection, which records miles driven without manual input, ensuring accurate data collection.

Additionally, GPS integration allows for precise route mapping, offering insights into travel patterns. Many smart trackers also provide real-time reporting, enabling users to generate detailed reports with ease. Furthermore, integration with expense management systems streamlines reimbursement processes.

User-friendly mobile applications enhance accessibility, allowing users to manage their mileage on-the-go. Lastly, enhanced data security features protect sensitive information, making these solutions not only efficient but also reliable for businesses seeking to optimize their travel expenditures.

Selecting the appropriate mileage tracker solution requires careful consideration of several factors that align with specific business needs. First, evaluate the software's ability to accurately track mileage using GPS or manual entry options, ensuring it fits your travel patterns.

Next, assess integration capabilities with existing systems, such as accounting or payroll software, to streamline processes. User-friendliness is essential; choose a solution that offers intuitive navigation and robust customer support.

Additionally, consider pricing models-some solutions charge monthly fees, while others may involve one-time purchases. Finally, prioritize data security measures to protect sensitive information. By thoroughly examining these factors, businesses can select a mileage tracker that enhances efficiency and supports overall travel management.

Integrating a mileage tracker with expense management systems streamlines the reimbursement process and enhances financial oversight. By automatically capturing and categorizing mileage data, businesses can eliminate manual entry errors and reduce processing time.

This integration provides real-time insights into travel expenses, enabling finance teams to promptly review and approve reimbursements. Furthermore, it simplifies compliance with tax regulations by maintaining accurate and detailed records of business-related travel.

Employees benefit from a seamless experience, as they can submit their travel expenses with minimal effort. Additionally, integrating these systems offers valuable analytics, allowing organizations to identify spending patterns and optimize travel budgets. Ultimately, this synergy fosters a more efficient, transparent, and accountable travel expense process.

A variety of mileage tracker apps are available today, each designed to simplify the task of tracking business-related travel. Among the top contenders, MileIQ stands out for its automatic tracking features and user-friendly interface.

Everlance offers a comprehensive solution with expense tracking and reporting functionalities, making it ideal for business professionals. TripLog not only tracks mileage but also integrates with various accounting software, enhancing overall efficiency.

For users seeking a budget-friendly option, Stride Tax provides essential features at no cost. Lastly, the QuickBooks Miles app is perfect for those already using QuickBooks, seamlessly integrating mileage tracking with expense management. These apps streamline the process, ensuring accurate tracking and reporting for all business travel.

Efficient mileage logging is essential for maximizing tax deductions and maintaining accurate records for business travel. To streamline your logging process, consider using a dedicated mileage tracking app that automatically records trips via GPS.

Ensure you categorize each trip as business or personal to simplify tax reporting. Regularly review your mileage log to confirm accuracy and completeness, making updates promptly to avoid discrepancies. Include details such as the date, purpose of the trip, and starting and ending odometer readings.

Set reminders to log your mileage at consistent intervals-daily or weekly-to avoid forgetting entries. Lastly, maintain a backup of your logs, whether digital or printed, to ensure you have accessible records in case of audits or inquiries.

A mileage tracker can significantly aid in logging personal use mileage by providing an efficient and systematic approach to recordkeeping. Utilizing a mileage tracker enables individuals to capture accurate data on distances traveled for personal purposes, ensuring compliance with tax regulations and facilitating reimbursement claims. Additionally, these tools often offer features such as automated tracking and reporting, which streamline the logging process and enhance the overall accuracy of mileage records for personal use.

Forgetting to log a trip can pose challenges in maintaining accurate records. It is advisable to establish a consistent routine for logging mileage immediately after each trip to minimize such occurrences. If a trip is forgotten, try to reconstruct the details based on available information, such as calendar entries or GPS data. Additionally, implementing reminders or using automated tracking tools can further ensure comprehensive and timely documentation of all travel activities.

Mileage tracking can significantly influence insurance premiums, as insurers often assess risk based on driving habits and mileage. Higher annual mileage typically correlates with increased risk of accidents, leading to potential premium hikes. Conversely, lower mileage may qualify drivers for discounts, as they are considered lower risk. Accurate tracking provides insurers with precise data, allowing for more tailored premiums that reflect individual driving patterns and vehicle usage, ultimately benefiting responsible drivers.