In today's complex legal landscape, the necessity of employing an estate planning attorney cannot be overstated. Families face a myriad of challenges, from safeguarding assets to ensuring the well-being of minor children, all while navigating ever-evolving laws.

An experienced attorney provides tailored strategies that address individual needs, helping to prevent disputes and minimize tax implications.

However, many overlook critical elements that can significantly impact their estate plans. Understanding these nuances is essential for every family, as the consequences of neglecting proper planning can be profound. What are the key considerations that families often miss?

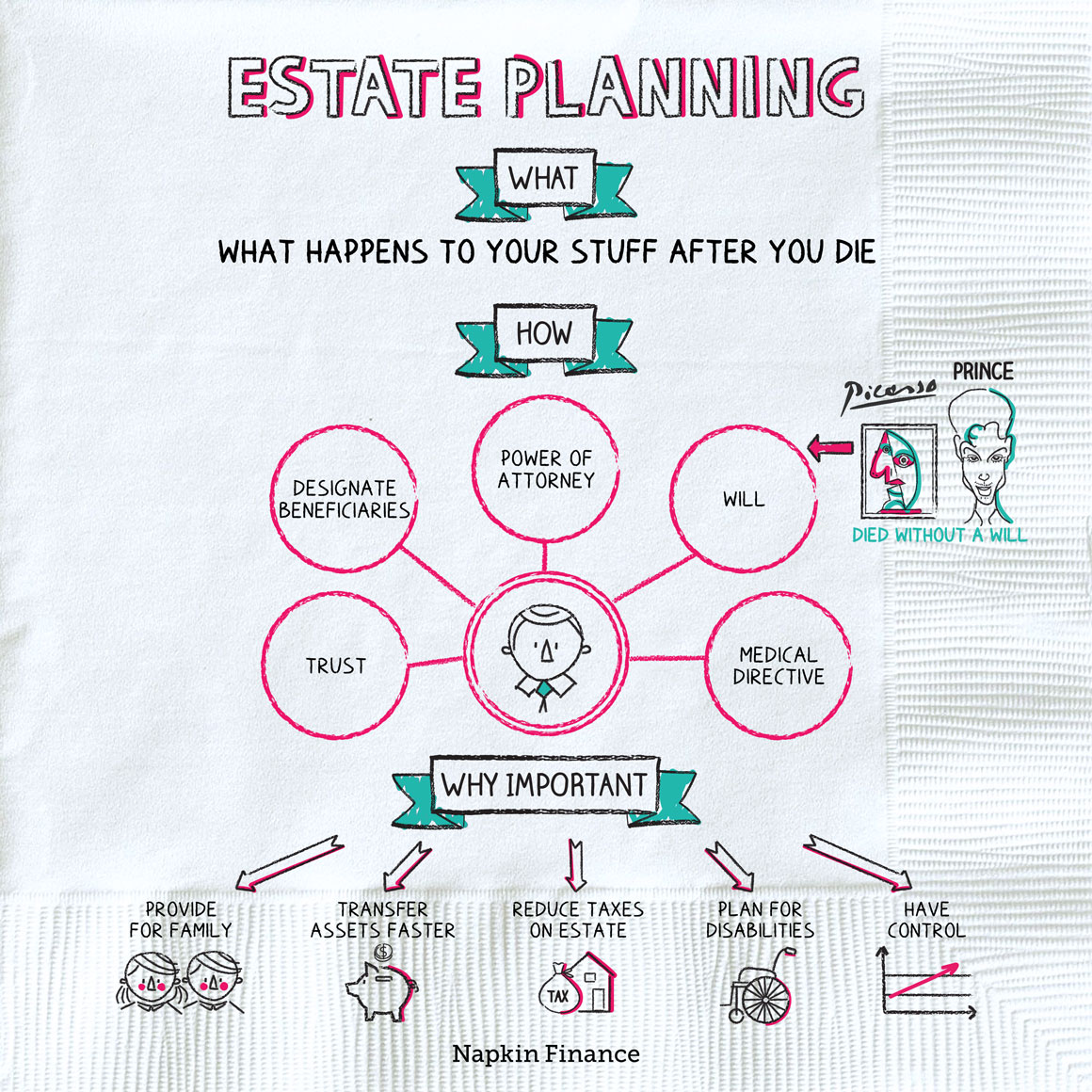

Understanding estate planning basics is essential for anyone looking to secure their financial legacy and provide for their loved ones. Estate planning involves the process of organizing and managing an individual's assets during their lifetime and determining how those assets will be distributed upon their death.

Key components include wills, trusts, powers of attorney, and healthcare directives. A well-structured estate plan ensures that your wishes are honored, minimizes tax liabilities, and mitigates potential disputes among heirs.

It is crucial to regularly review and update your estate plan as circumstances change, such as marriage, divorce, or the birth of children. Engaging with a qualified estate planning attorney can provide invaluable guidance to navigate this complex process effectively.

A tailored estate plan is crucial for effectively addressing the unique needs and circumstances of each individual or family. Generic plans often fail to consider specific assets, family dynamics, and personal goals, which can lead to unintended consequences.

A customized approach ensures that your wishes regarding asset distribution, guardianship, and healthcare decisions are clearly articulated and legally enforceable. Additionally, tailored plans take into account tax implications, potential probate issues, and the specific laws of your state, thereby minimizing future conflicts and complications.

By engaging an estate planning attorney, families can create a comprehensive strategy that reflects their values and priorities, ultimately providing peace of mind and security for both the testator and their beneficiaries.

Creating a tailored estate plan not only addresses individual needs but also helps in recognizing and avoiding common legal pitfalls that can arise during the planning process. One frequent issue is the lack of proper documentation, which can lead to disputes among beneficiaries.

Additionally, failing to update estate plans after major life events-such as marriage, divorce, or the birth of a child-can result in unintended consequences. Misunderstanding state laws regarding wills and trusts may also create complications, emphasizing the importance of legal guidance.

Furthermore, neglecting to consider tax implications can diminish the estate's value. Engaging an experienced estate planning attorney ensures that these pitfalls are navigated effectively, providing peace of mind and protecting your family's interests.

Establishing a comprehensive estate plan is crucial for safeguarding the interests of minor children. Parents must designate guardians who will assume responsibility for their children in the event of their untimely passing.

This designation not only ensures that children are cared for by trusted individuals but also minimizes potential conflicts among family members. Additionally, establishing a trust can provide financial security, managing assets until the children reach maturity.

An estate planning attorney can assist in drafting legally binding documents that reflect the parents' wishes while adhering to state laws. Furthermore, regular reviews of the estate plan are essential, as life changes may necessitate updates to guardianship or financial arrangements, ensuring that the plan remains relevant and effective.

Increasingly, individuals are recognizing the importance of managing digital assets as part of their estate planning. Digital assets encompass a wide range of online properties, including social media accounts, digital currencies, and cloud storage files.

These assets can hold significant sentimental and financial value, making their management crucial. An estate planning attorney can assist in creating a comprehensive plan that outlines how these assets should be accessed, transferred, or preserved after one's passing.

This process often involves designating trusted individuals to handle digital accounts, ensuring that passwords and access information are securely documented. Individuals can prevent potential disputes and ensure their digital legacy aligns with their overall wishes, providing peace of mind for families.

When considering passing on digital assets in an estate plan, individuals can explore various options. These may include creating a detailed inventory of digital assets, designating a digital executor to manage these assets, and specifying instructions for the distribution or deletion of digital accounts. Utilizing online password managers or secure storage solutions can also facilitate the organization and transfer of digital assets to designated beneficiaries according to the estate plan.

Common mistakes in estate planning without a family-centered approach include overlooking potential conflicts among beneficiaries, failing to communicate intentions clearly, neglecting to update documents regularly, and not considering the impact of taxes on inheritances. Without a focus on family dynamics, individuals may inadvertently leave behind a legacy that leads to disputes and confusion among loved ones. It is essential to involve family members in discussions and decisions to ensure a more harmonious and effective estate plan.

Estate planning can shield assets from potential lawsuits or creditor claims by utilizing legal tools such as trusts, limited liability entities, and insurance policies. Properly structured trusts can protect assets from being seized by creditors, while entities like limited liability companies can limit personal liability. Insurance policies, like umbrella policies, can provide an additional layer of protection. Consulting with experienced estate planning professionals can help tailor a strategy to safeguard assets effectively.