Crafting a legacy is a meticulous process that requires thoughtful consideration and strategic planning. Dedicated estate planning attorneys play a crucial role in tailoring solutions that align with your unique circumstances and aspirations for the future.

As we navigate the complexities of estate planning, these professionals serve as guides, helping individuals and families navigate the intricacies of wills, trusts, and asset protection strategies.

By entrusting your legacy to skilled attorneys who specialize in this area, you can ensure that your wishes are not only documented but also implemented effectively. The journey towards crafting a lasting legacy involves more than just legal documentation; it involves creating a roadmap for the future that reflects your values and priorities.

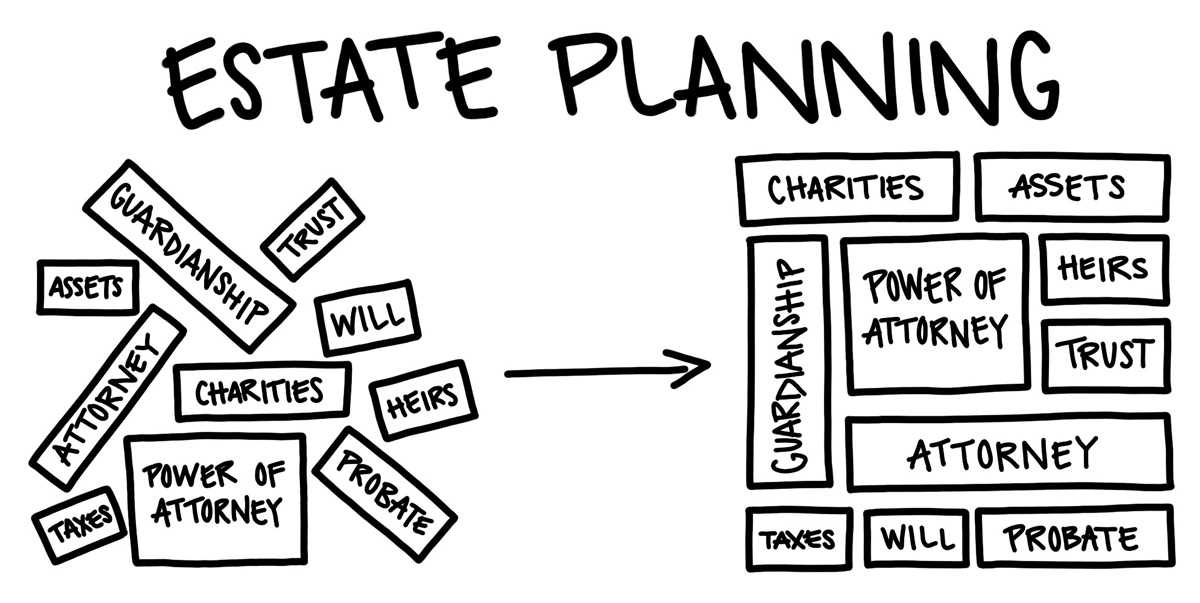

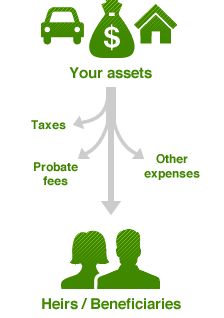

Estate planning is a crucial process that ensures the orderly transfer of assets and protection of individuals' wishes upon death or incapacitation. By engaging in estate planning, individuals can dictate how their assets are distributed, appoint guardians for minor children, minimize estate taxes, and outline healthcare preferences in case of incapacity.

Without a comprehensive estate plan, state laws will determine how assets are divided, potentially leading to disputes among family members and unexpected tax liabilities.

Estate planning also allows individuals to specify charitable contributions, establish trusts to protect assets, and designate beneficiaries for retirement accounts and life insurance policies. Ultimately, estate planning provides peace of mind by ensuring that one's wishes are carried out efficiently and effectively.

Given the complex nature of legal matters surrounding asset distribution and healthcare preferences, the guidance and expertise of dedicated attorneys play a vital role in ensuring the seamless execution of individuals' estate plans.

Estate planning attorneys serve as trusted advisors, helping clients navigate intricate laws and regulations to protect their assets and families. These professionals work closely with individuals to understand their unique circumstances, goals, and concerns, tailoring comprehensive strategies that align with their wishes.

Dedicated attorneys bring a depth of knowledge and experience to the table, offering personalized solutions for wills, trusts, powers of attorney, and healthcare directives. By engaging with skilled estate planning attorneys, individuals can establish clear plans that safeguard their legacies and provide peace of mind for themselves.

In the realm of estate planning, the art of crafting lasting legacies requires meticulous attention to detail and a deep understanding of individual goals and values. Estate planning attorneys play a crucial role in helping individuals shape their legacies by translating their aspirations into concrete legal strategies.

By working closely with clients, attorneys can tailor estate plans that reflect not only financial considerations but also personal beliefs, family dynamics, and philanthropic desires. Ensuring that these plans are comprehensive and flexible is essential for adapting to changing circumstances and laws.

Crafting lasting legacies involves not only drafting documents but also fostering open communication, building trust, and providing ongoing support to clients and their families to preserve and protect their unique legacies for generations to come.

Crafting a successful estate plan hinges on the implementation of effective planning strategies that align with the individual's objectives and legal considerations. One key strategy is establishing clear directives through wills or trusts to ensure assets are distributed according to the individual's wishes.

Maximizing tax efficiency by utilizing tools such as lifetime gifting, charitable trusts, or family limited partnerships is another crucial aspect of effective estate planning. Moreover, considering the implications of incapacity and implementing powers of attorney can safeguard decision-making processes in unforeseen circumstances.

Regularly reviewing and updating the estate plan to reflect life changes or evolving legal requirements is essential to maintain its effectiveness. By employing these strategies with the guidance of experienced estate planning attorneys, individuals can secure their legacies and protect their assets for future generations.

Understanding the nuances of wills and trusts is foundational in estate planning; however, an equally critical aspect to consider is the importance of advance directives.

Advance directives, such as living wills and healthcare proxies, allow individuals to outline their preferences for medical care and designate someone to make healthcare decisions on their behalf if they become unable to do so. These documents ensure that personal wishes regarding medical treatment are known and respected, providing peace of mind for both the individual and their loved ones.

By incorporating advance directives into estate plans, individuals can proactively address potential healthcare scenarios, maintain control over their medical care, and alleviate the burden of decision-making during challenging times. Prioritizing advance directives is a key component of comprehensive estate planning.

Implementing strategic asset protection measures is crucial in safeguarding wealth and ensuring financial security for individuals and their beneficiaries. Estate planning attorneys play a vital role in structuring asset protection solutions tailored to each client's unique circumstances.

Through the use of legal tools such as trusts, limited liability entities, and insurance products, individuals can shield their assets from potential creditors, lawsuits, or other threats. Trusts, in particular, offer a versatile mechanism for protecting assets while allowing for flexibility in managing and distributing wealth over time.

By working closely with experienced estate planning attorneys, individuals can proactively address potential risks to their assets and establish a solid foundation for their financial legacy. Asset protection strategies should be integrated into a comprehensive estate plan to provide maximum security and peace of mind.

Estate planning attorneys play a crucial role in safeguarding assets from potential creditors and lawsuits by employing legal strategies tailored to each client's unique circumstances. They can establish trusts, utilize legal entities, and structure ownership arrangements to shield assets from potential threats. With their expertise in estate law and asset protection, these attorneys provide valuable guidance to ensure that assets are protected and preserved for future generations.

When individuals attempt to create wills and trusts without professional guidance, common mistakes arise. These errors may include incorrect language leading to ambiguous interpretations, improper signing and witnessing procedures rendering documents invalid, overlooking crucial estate planning considerations, such as tax implications, or failing to update documents to reflect changing circumstances. Professional estate planning attorneys provide expertise to help individuals navigate these complexities and ensure their wishes are accurately and legally documented.

Estate planning plays a crucial role in ensuring the smooth transition of ownership for family businesses. By establishing a comprehensive estate plan that includes provisions for the transfer of business assets, you can mitigate potential conflicts and uncertainties among family members. Through mechanisms like trusts, buy-sell agreements, and succession plans, estate planning can facilitate a seamless transfer of ownership, preserve the business's legacy, and provide clarity on decision-making processes during transitions.